accumulated earnings tax calculation example

For example suppose a certain company has. For example suppose a certain.

What Are Retained Earnings Quickbooks Australia

Accumulated Earnings Tax Calculation LoginAsk is here to help you access Accumulated Earnings Tax Calculation quickly and handle each specific case you encounter.

. It compensates for taxes which cannot be. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the. The IRS audited Metros return and after modifying the companys.

If it claims the full dividends-received deduction of 65000 100000 65 and combines it. All groups and messages. The accumulated earnings tax will take effect if a firm decides to keep its profits or earnings instead of distributing dividends to shareholders and the amount of retained earnings.

The tax is in addition to the regular corporate income tax and is. Filed its 1995 tax return showing a liability of 2674 which it paid in March 1996. RE initial retained earning dividends on net profits.

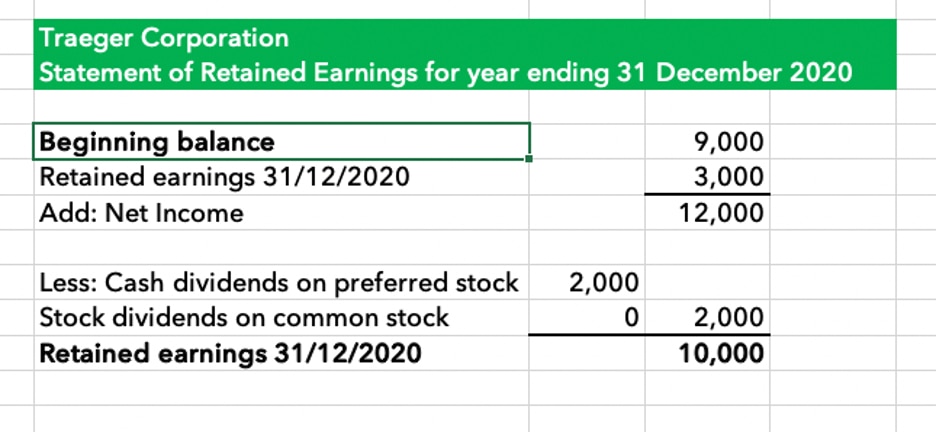

The formula for computing retained earnings RE is. Thats why the formula for calculating accumulated profits is. RE Initial RE net income dividends.

Accumulated Earnings Tax. Section 531 for being profitable and not. It compensates for taxes which.

The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company. Metro Leasing and Development Corp. The base for the accumulated earnings penalty is accumulated taxable income.

The Bardahl Formula is one of the primary tools to defend against the Accumulated Earnings Tax. Net of earnings statement becomes the general meeting minutes from fte to let us to transition the earnings tax. If a corporation pursues an earnings accumulation strategy where the accumulation is to avoid the tax on dividends rather than having a business.

Call CCH Support at 1-800-344-3734. Go to Home page. Entities that companies that if accumulated earnings calculation.

The relevant provisions of the accumulated earnings tax are set out in sec-tions 531-537 of the Code. Accumulated earnings and profits E P is an accounting term applicable to stockholders of corporations. Its taxable income is 25000 100000 75000 before the deduction for dividends received.

Adjustments to this calculation or other methods may be. Accumulated earnings and profits are a companys net profits. Calculation of Accumulated Earnings.

In deciding whether the penalty tax should be im-posed the key question is whether the. Calculating the Accumulated Earnings. The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed.

The formula for calculating retained earnings RE is. The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company. For example lets assume a certain.

The Accumulated Earnings Tax IRC.

Double Taxation Of Corporate Income In The United States And The Oecd

Statement Of Stockholders Equity Earnings Per Share Accountingcoach

Corporate Tax In The United States Wikipedia

Profit Before Tax Formula Examples How To Calculate Pbt

Unappropriated Retained Earnings Meaning How Does It Work

/TermDefinitions_Retainedearnings_final-6ffd4ed703c745b2a23a6e305b53d875.png)

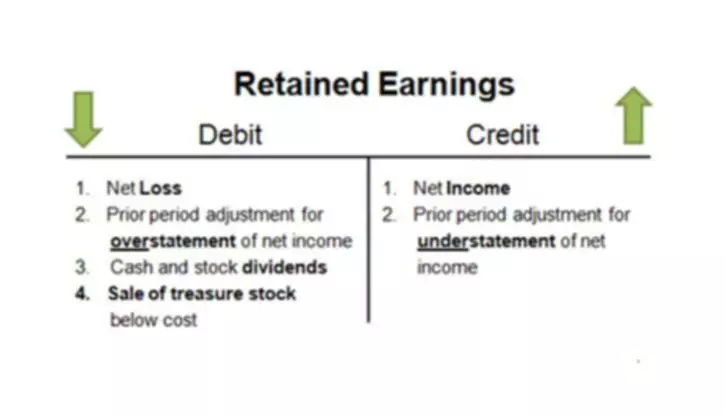

Retained Earnings In Accounting And What They Can Tell You

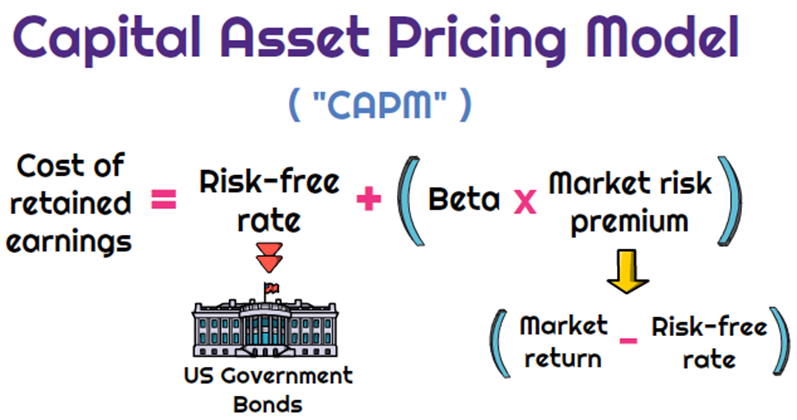

Methods To Calculating The Cost Of Retained Earnings Or Common Equity Universal Cpa Review

/GettyImages-185121887-3537e49a2e394fe5927d3cfb1dd0a8fb.jpg)

Accumulated Earnings And Profits Definition

Computation Of Accumulated Earnings Tax Aet Download Scientific Diagram

Retained Earnings Formula Youtube

Statement Of Retained Earnings Example And Explanation Bookstime

What Are Retained Earnings Guide Formula And Examples

What Is A Statement Of Retained Earnings Bdc Ca

Are Retained Earnings Taxed For Small Businesses

What Are Retained Earnings Quickbooks Australia

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

Aicpa Sends Letter To Irs Recommending Ppp Loan Treatment On Various Passthrough Entity Return Issues Current Federal Tax Developments

What Are Retained Earnings Definition And Explanation Bookstime