unified estate tax credit 2020

Chapter 57 of the Laws of 2010 amended section 951a of the Tax Law in relation to the unified credit for the New York State estate tax. The estate and gift tax exemption for 2021 is 117 million.

Federal Marginal Tax Rates After Unified And State Death Tax Credits 1997 Download Table

The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019.

. In 2020 after adjustment for inflation it was raised to 1158 million for individuals and 2316 million for a married couple. For more information see the General Information section and the instructions for lines 13 and 26 on Form ET-706-I and also TSB-M-19-1E. The lifetime gift tax exclusion in 2020 is 1158 million meaning the federal tax law.

The unified tax credit applies to two or more different tax credits that apply to similar taxes. For example for 2020 the US. The unified credit is a credit for the portion of estate tax due on taxable estates mandated by the Internal Service Revenue IRS to combine both the federal gift tax and estate tax into one.

Find some of the more common questions dealing with basic estate tax issues. Prior to the amendment the unified credit referenced the federal Internal Revenue Code. For 2021 the estate and gift tax exemption stands at.

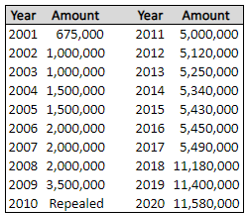

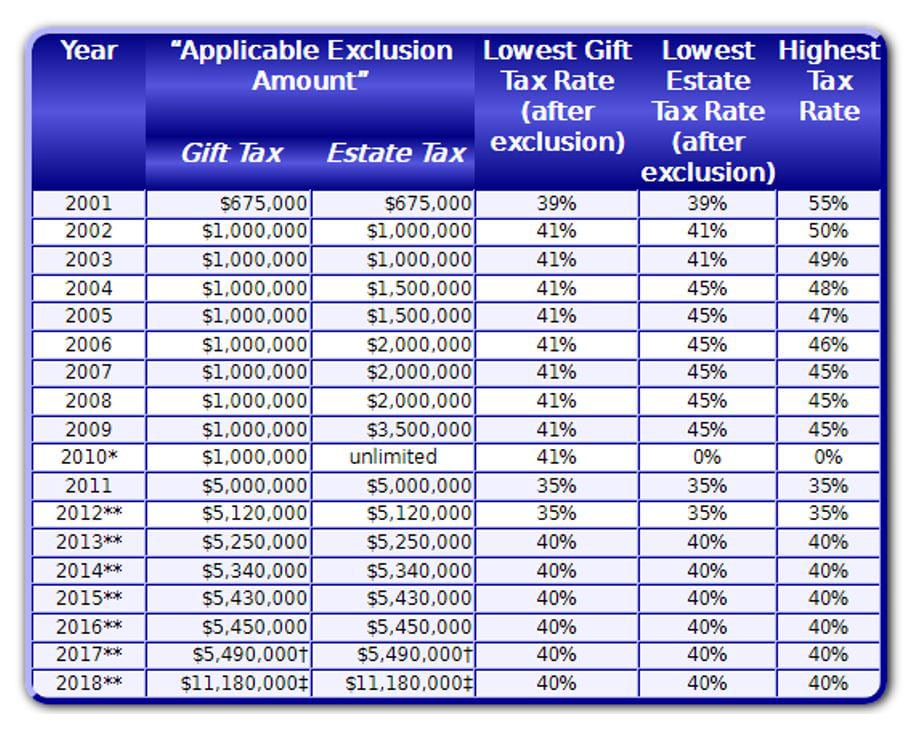

The size of the estate tax exemption meant that a mere 01 of estates filed an estate tax return in 2020 with only about 004 paying any tax. Federal Unified Credit or 2058 Deduction 2021. Estate tax returns are required when the total gross value of the estate exceeds the amount shown in the following table.

This credit allows each person to gift a. It can be used by taxpayers before or after death integrates both the gift and estate taxes into one tax system is adjusted for inflation and has no income limit. Unified estate and gift tax credit 2020 Tuesday March 15 2022 Edit.

In the case of estate and gift taxes the unified tax credit provides a set amount that any individual can gift during their lifetime before any of these two taxes apply. Not over 2600 10 of taxable income Over 2600 but not over 9450 260 plus 24 of the amount over 2600. If you are concerned that your total wealth may exceed any future unified tax credit or estate tax exception you may want to consider strategies to take advantage of the existing 1158 million dollar credit such.

It will then be taken as a credit against any. Federal Minimum Filing Requirement. If you made other taxable gifts during life then the Unified Credit available at your.

It can be used by taxpayers before or after death integrates both the gift and estate taxes into one tax system is adjusted for inflation and has no income limit. Is added to this number and the tax is computed. Start filing for free online now.

Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections or jointly. The benefit of the unified tax credit is anyone can take advantage of this perk. Your available Unified Credit is effectively reduced from 1158 million to 11 million.

In 2020 after adjustment for inflation it was raised to 1158 million for individuals. While Congress can vote to make the 117 million exception permanent the Biden administration has pledged to drastically decrease the Unified Credit for Estate taxes from 117 million to 35 million and the credit for gift taxes to 1 million. Get information on how the estate tax may apply to your taxable estate.

MANAGING YOUR MONEY. If you die in 2020 after making such a taxable gift you will still be able to transfer assets worth 11 million through your will trust or otherwise estate tax-free. The unified tax credit is designed to decrease the tax bill of the individual or estate.

Such election once made shall be. You have a yearly allowance per person you gift assets to and theres a lifetime gift exclusion too. A deceased spousal unused exclusion amount may not be taken into account by a surviving spouse under paragraph 2 unless the executor of the estate of the deceased spouse files an estate tax return on which such amount is computed and makes an election on such return that such amount may be so taken into account.

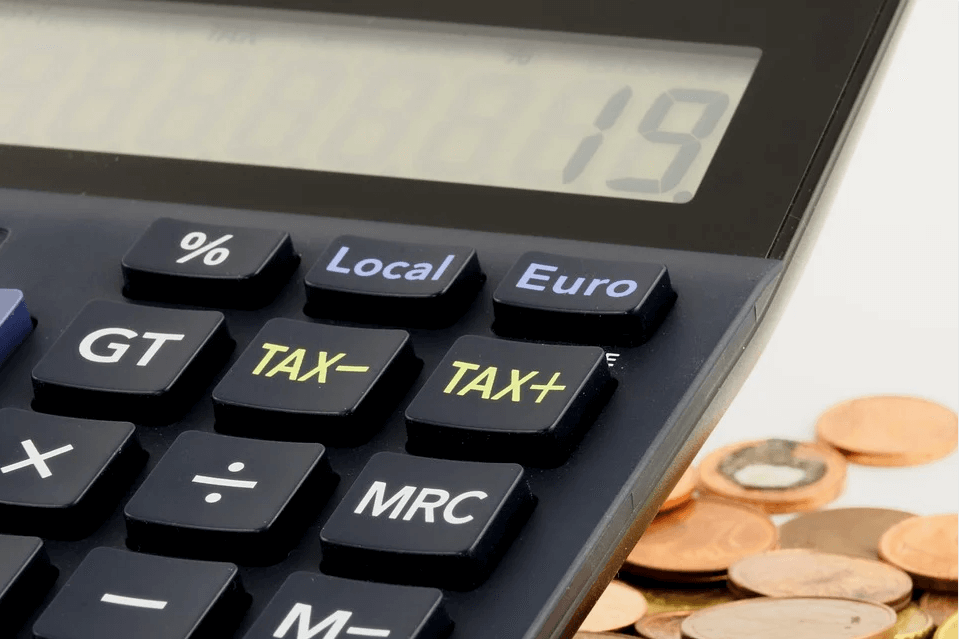

For 2020 US residents and citizens are entitled to a US estate tax unified credit of approximately 4577800 which essentially exempts 1158 million of property from estate tax. Import tax data online in no time with our easy to use simple tax software. Beyond that exemption donors pay gift tax at the estate tax rate of 40 percent.

Unified Tax Credit Definition. Estate and Gift Taxes. The IRS announced new estate and gift tax limits for 2021 during the fall of 2020.

A key component of this exclusion is the basic exclusion amount BEA. The IRS issued final regulations that reconcile the current higher exclusion for the estate and gift tax unified credit amount in effect under the law known as the Tax Cuts and Jobs Act with the lower unified credit which is scheduled to go into effect in 2026 eliminating a possible future clawback of the higher. The 1206 million exemption applies to gifts and estate taxes combinedany portion of the exemption you use for gifting will reduce the amount you can use for the estate tax.

Eliminate estate and gift tax clawback. Estate tax exemption amount is US1158 million which if expressed as a unified credit amounts to US4577800. Estate tax exemption which may also be expressed in the form of a unified credit.

For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million. Share to Twitter. However the federal estate tax is not currently in effect for 2010 and its status remains uncertain.

A tax credit that is afforded to every man woman and child in America by the IRS. Then you take the 1158 million number and figure out what the estate tax on that. The Internal Revenue Service announced today the official estate and.

Any tax due is determined after applying a credit based on an applicable exclusion amount. A tax credit is said to be unified when it applies to twoor. Ad Over 85 million taxes filed with TaxAct.

Included in New Yorks newly enacted budget is a graduated increase in estate tax exclusion amount that will effectively eliminate estate tax for many residents and provide significant relief. Unified Tax Credit. Situs property transferred to your heirs Please contact us.

Estate Tax Credit Equivalent 2141800 4417800 4505800 4577800. To claim a portion of a US. After 2025 the exemption will revert to the 549 million exemption adjusted for inflation.

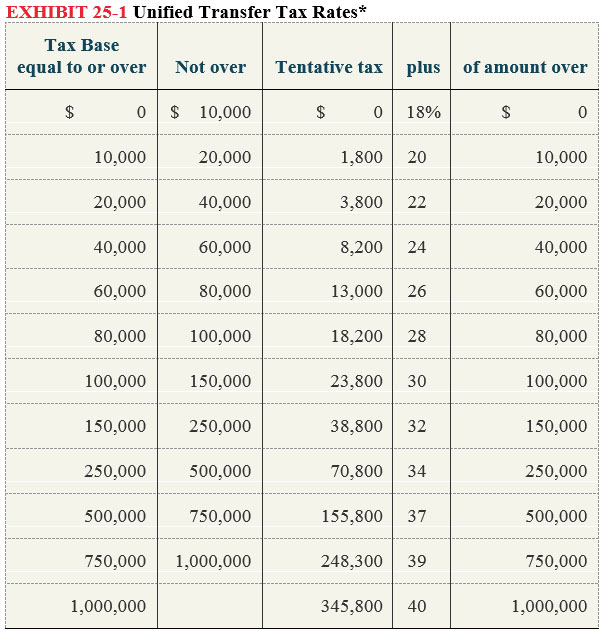

The IRS refers to this as a unified credit Each donor the person making the gift has a separate lifetime exemption that can be used before any out-of-pocket gift. Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a top marginal rate of. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax.

The tax is then reduced by the available unified credit.

A Look At 2020 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

History Of The Unified Tax Credit Apple Growth Partners

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Federal Marginal Tax Rates After Unified And State Death Tax Credits 1997 Download Table

Historical Features Of The Estate Tax Download Table

Is My Estate Subject To Tax Udall Shumway Law Firm Phoenix Az

Historical Features Of The Estate Tax Download Table

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

How The Unified Tax Credit Maximizes Wealth Transfer Blog Jenkins Fenstermaker Pllc

Tax Related Estate Planning Lee Kiefer Park

Federal Marginal Tax Rates After Unified And State Death Tax Credits 1997 Download Table

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

How To Advise Your Clients Under The New Estate Tax Law Ppt Download

Gift Tax Unified Tax Credit Estate Tax Corporate Income Tax Course Cpa Exam Far Youtube

Solved Gabriel Had A Taxable Estate Of 8 4 Million When He Chegg Com

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services